LEARN HOW TO BE MORE PROFITABLE…

Financial Model Workbook

Is Your Financial Model Toxic?

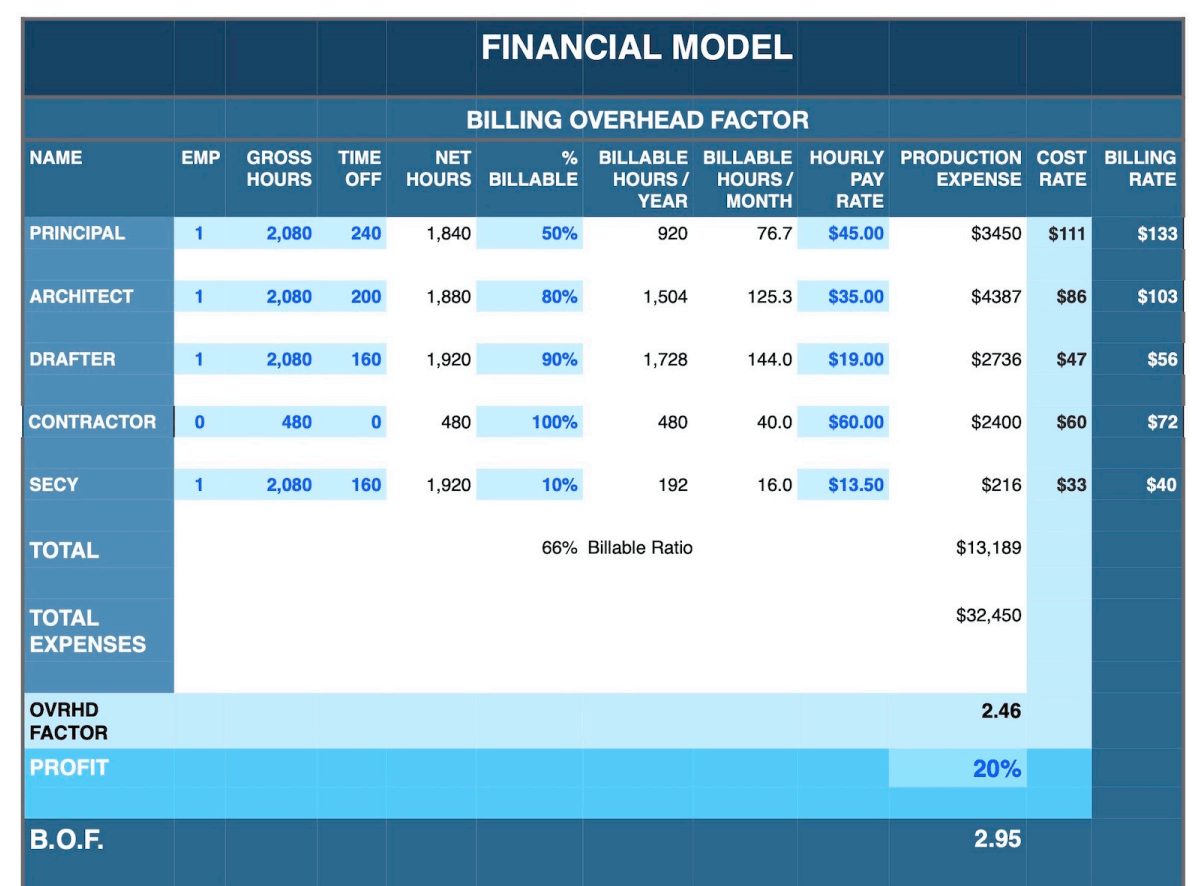

Using the Financial Model Workbook is a simple way to find out how to be profitable in your unique organization.

After collecting a few pieces of information, you will have the key to profitability, and a roadmap for achieving it.

See just how simple it is in the video.

There are just 4 numbers in your financial model

PH x BR = TE + P

PH

Project Hours

Take all your hours spent working on billable projects...

BR

Billing Rate

Multiply by the billing rate that you charge for those hours...

TE

Total Expenses

That sum is equal to your total expenses from all sources, plus...

P

Profit Target

Your proKt, or loss as required by this equation.

Are your numbers balanced for profitability or liability?

My Story

I learned the 'secret' of the financial model for architects three years after starting my firm by attending a workshop given by a fellow architect. I discovered that when I used hourly rates I was losing $15 per hour.

I was flying blind, and it wasn't going to end well.

Throughout my career I have used this method and it has never let me down. The Financial Model Workbook is the result of working to make the model easy to use because every architect needs to know how this works.

A Simple Tool For The Small-Firm Architect

The Financial Model Workbook is simple. Enter a name and 4 pieces of data about each employee (contract workers supported). Three more numbers and your model is complete.

Financial Model Workbook

✔ Shows you how well your model Shows you how well your model works

✔ Gives you the key ratio for Gives you the key ratio for profitability profitability

✔ You can easily determine where You can easily determine where to make changes to make changes

✔ See the impact of contract See the impact of contract workers workers

Get the Financial Model Workbook today and get your firm in balance

➜ The workbook comes ready to use

➜ The spreadsheet comes in Excel xlsx, and Apple Numbers formats

➜ There are step by step instructions

➜ Indicates your breakeven rate and min billing rate

➜ Provides guidance for improving your model